Today, I opened a small position in $BYIT.L. Here’s why?

Beyond the Headlines: Why Bytes Technology Group (BYIT) Still Commands My Attention

As an analyst, I spend my days poring over financial reports, breaking down market trends, and trying to make sense of all the chaos. It’s a tough job that requires both a strong analytical mind and a keen eye for detail, especially when it comes to figuring out if a company has the potential to be a “long-term winner”—a business that can keep shareholders happy for years to come, not just for a short time.

Lately, I’ve been keeping a close eye on Bytes Technology Group ( $BYIT.L ), a UK-based company that’s been making waves lately - for the wrong reasons.

The headlines haven’t been very flattering lately. A sudden CEO resignation, followed by a profit warning that sent the share price crashing by a third in just one day. For many, such news is a clear sign to run for the hills. But for a long-term investor, it’s often exactly when the market overreacts that the best opportunities come to light. My deep dive into Bytes suggests that beneath all the recent chaos lies a business that’s tough as nails, making a steady stream of cash, and has some serious advantages over its competitors. And guess what? The market is ripe for them to keep growing and growing.

The Unsung Hero of the Digital Age

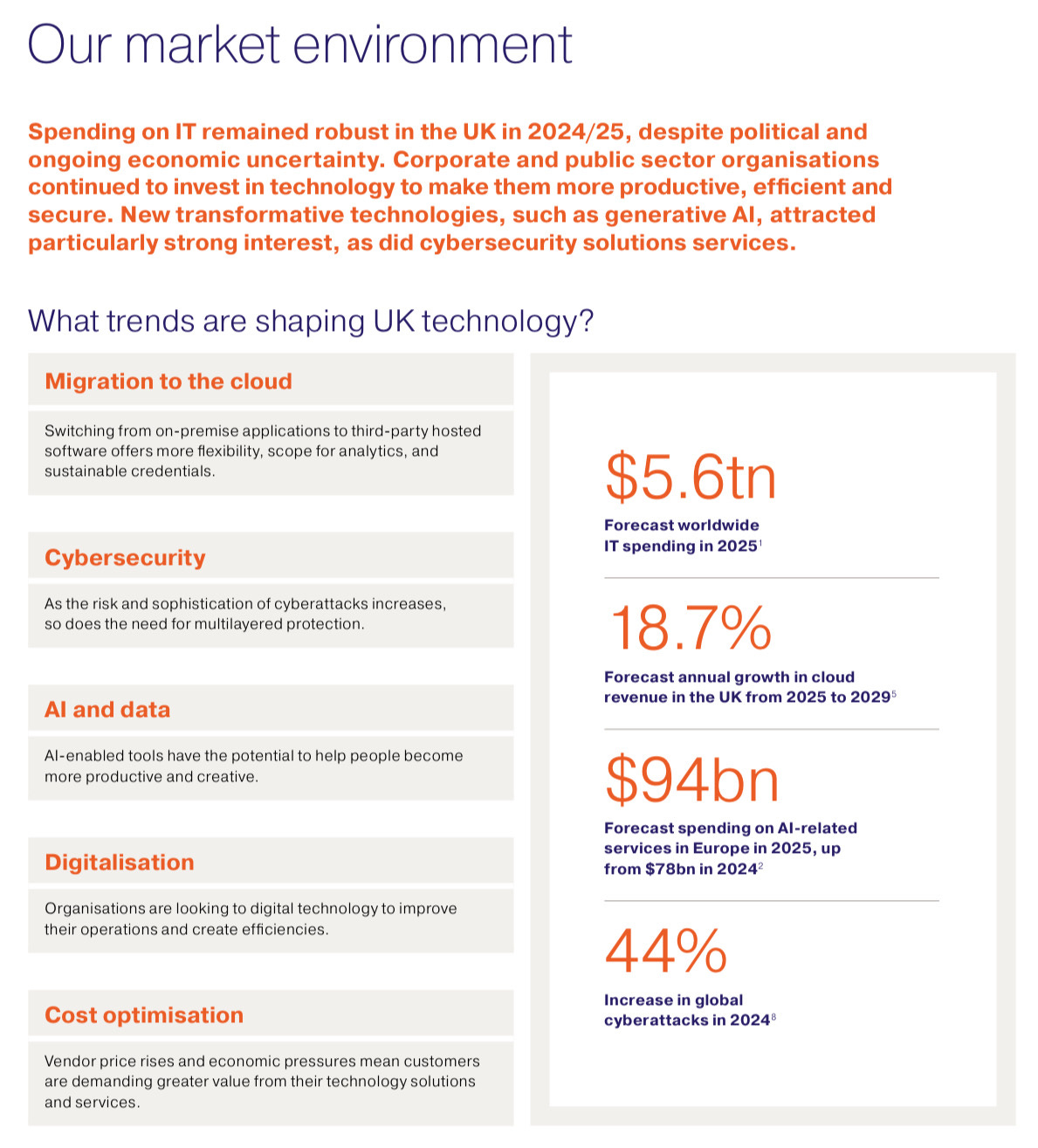

At its heart, Bytes Technology Group is a critical enabler in the complex world of IT. They don't invent the next big software; instead, they act as a trusted intermediary, a "Value Added Reseller" (VAR), simplifying technology adoption for thousands of private and public sector organisations across the UK and Ireland. Think of them as the expert guides navigating the ever-shifting digital landscape, providing the crucial "expertise, knowledge and advice" that clients need to make strategic IT investment decisions.

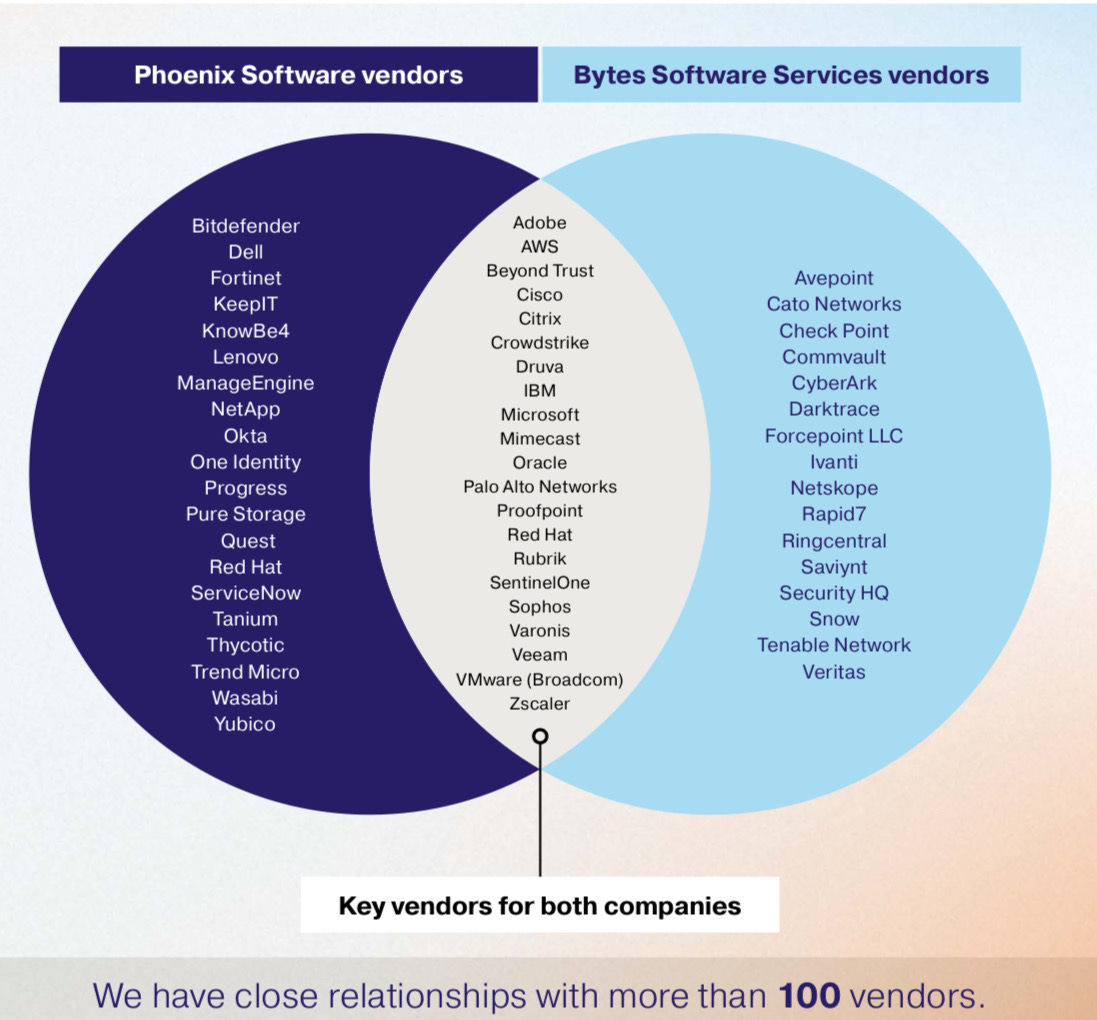

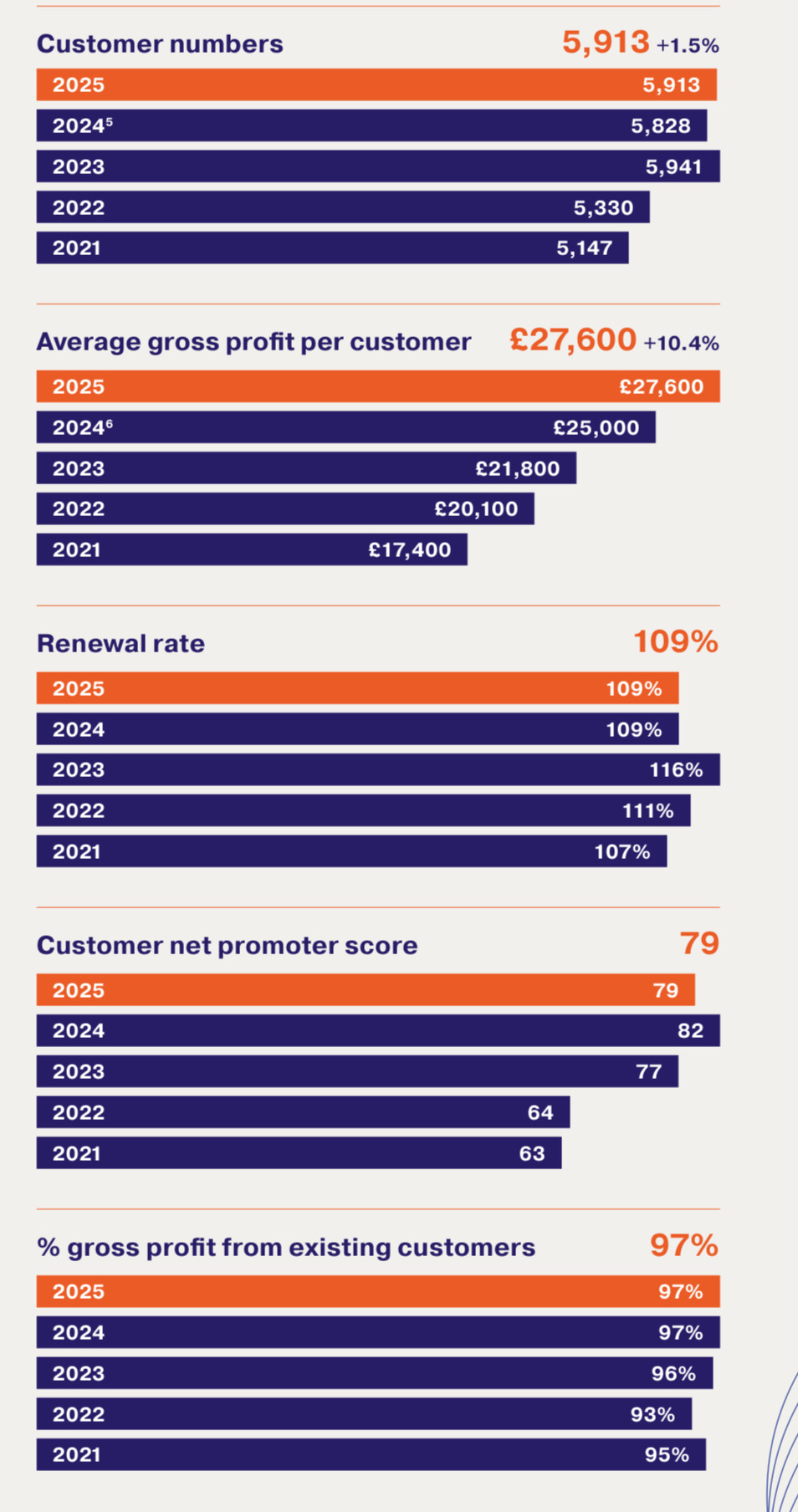

Their offerings cover software, IT security, hardware, and cloud services. Software makes up a whopping 92% of their revenue! They’re really focused on growing areas like cloud solutions, cybersecurity, and Artificial Intelligence (AI). Along with selling licenses; they offer managed services, help with deployments, and provide strategic consulting. They are right there with their clients, making sure everything runs smoothly. In fact, 98% of their gross profit in the first half of FY25 came from their existing customers, and they have a 107% renewal rate! That shows how loyal their customers are and how well their services stick with them.

The Moats That Matter

Warren Buffett, the legendary investor, talks about “economic moats”—super strong competitive advantages that keep a company thriving in the long run. Even though Bytes only has about 3% of the market in the UK IT services industry, which is quite competitive, it still has a few of these moats.

First off, customer loyalty and high switching costs are super important. Once a business switches to Bytes, it’s a big deal, and the costs and disruptions are pretty steep. But guess what? Bytes has 92% gross profit renewal rate! That’s pretty impressive, by any standard.

Secondly, Bytes is a key player in the tech world. Big software companies like Microsoft (where Bytes is the UK’s biggest reseller) rely heavily on VARs like Bytes to get their products to the market. This partnership gives Bytes special access and insights that other vendors don’t have.

Thirdly, Bytes is incredibly knowledgeable and offers top-notch advisory services. In today’s fast-paced tech world, businesses need reliable advice on complex areas like cloud computing, cybersecurity, and AI. Bytes is there to provide impartial, expert guidance that helps businesses make informed decisions. They’ve gone beyond just being a vendor; they’ve become trusted partners.

Lastly, Bytes has a fantastic company culture and keeps its employees happy and engaged. They’ve managed to lose only one of their top 50 salespeople in the past five years, which is a testament to their stable and experienced workforce. This ensures consistent, high-quality service and helps them preserve all their valuable knowledge.

Navigating the Squalls: Headwinds and Resilience

No business operates in isolation, and Bytes has certainly encountered its fair share of challenges. The recent profit warning mentioned

“some customers putting off buying decisions, especially in the corporate world,”

which is a direct result of the tough economic climate. Additionally, they’ve made some changes to their corporate sales division, moving to specialised teams, which has caused a

“longer-than-expected adjustment period”.

Even changes to Microsoft’s enterprise incentives, from transaction-based to activity-based rewards, have had a short-term effect.

However, it is crucial to perceive these as transient operational difficulties rather than fundamental shortcomings. Management anticipates a resumption of “normalised growth” in the latter half of FY25.

The underlying structural tailwinds persist: accelerated digital transformation, surging cloud adoption (85% of UK businesses now utilise cloud computing, with public sector spending increasing by 23% annually), escalating cybersecurity threats (UK spending has risen by 42% between 2021 and 2023), and the transformative integration of artificial intelligence (68% of UK enterprises are implementing or planning AI solutions by 2024). Bytes is proactively capitalising on these factors, selling over 130,000 Microsoft Copilot licenses and establishing specialised AI teams.

The Engine of Compounding: Financial Strength

My assessment using my Enduring Compounding Framework reveals a business with exceptional financial health.

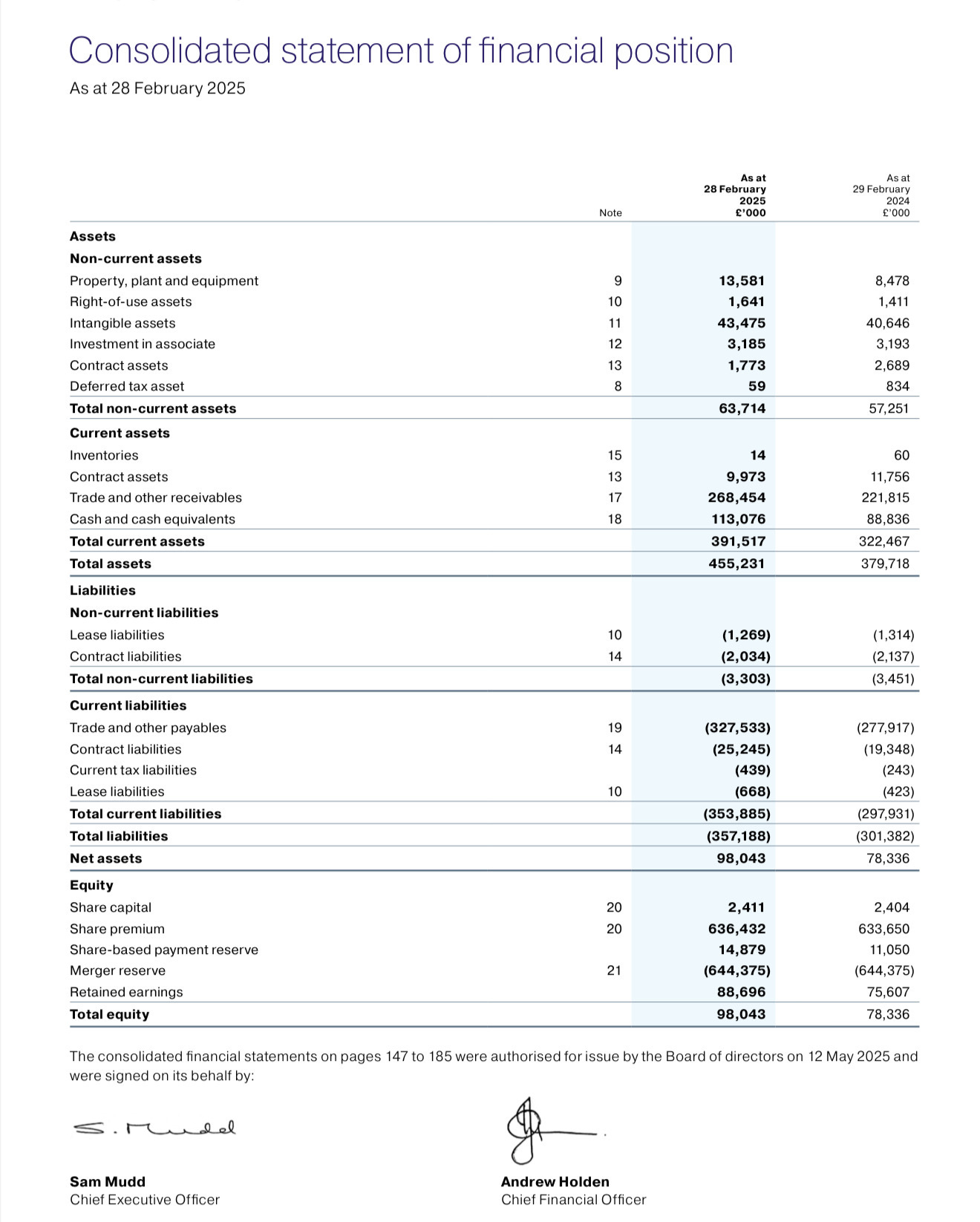

Fortress Balance Sheet (Score: 5/5): Bytes operates with a substantial net cash position and virtually no debt. In the first half of FY25, closing cash was £71.5 million. Notably, Bytes explicitly states that it has

“net cash, zero debt — no refinancing cliff risk”.

This financial prudence offers significant flexibility, safeguarding them from economic fluctuations and facilitating strategic investments.

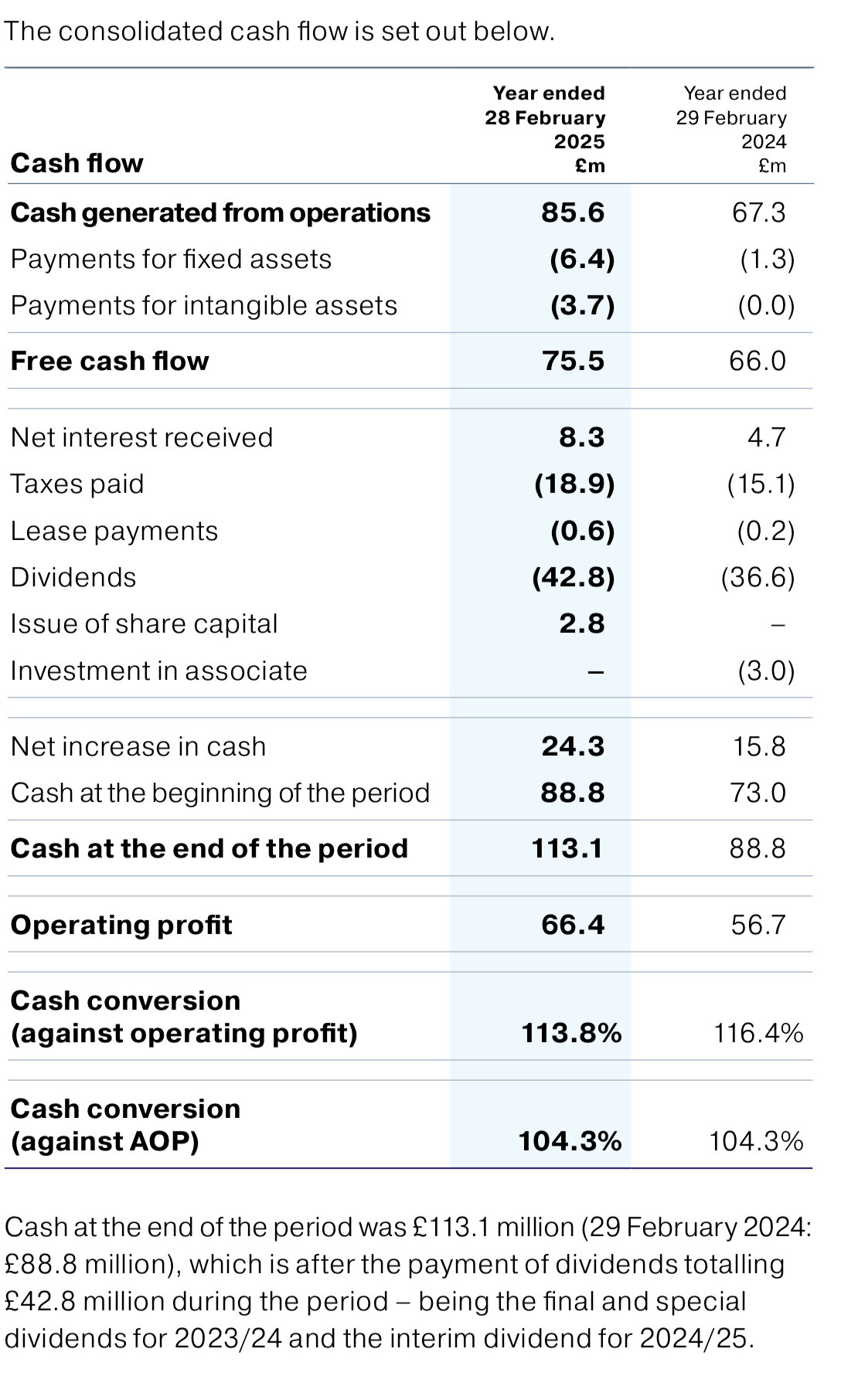

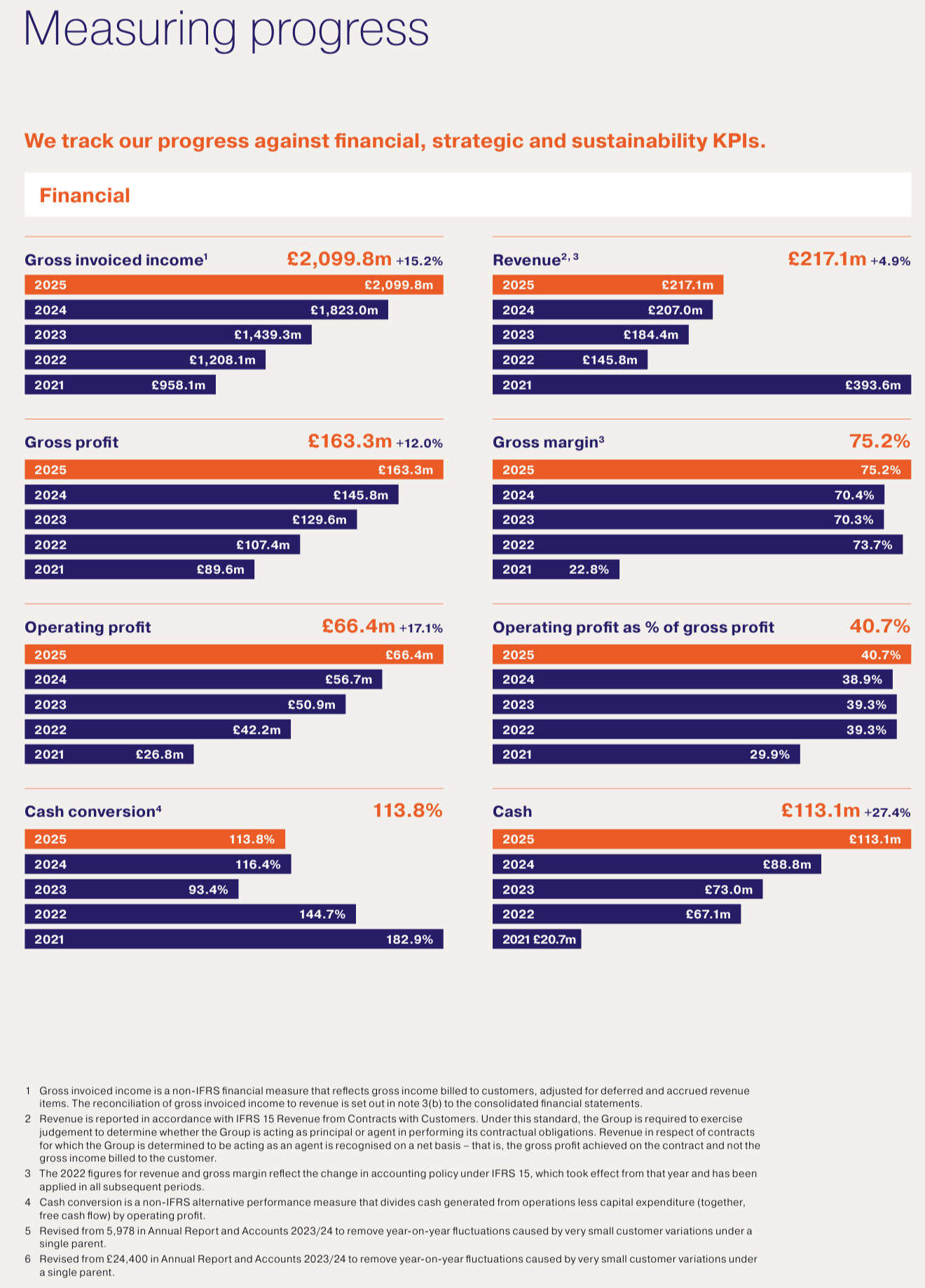

Relentless Free Cash Flow Generation (Score: 5/5): Free Cash Flow (FCF) has experienced substantial growth, reaching £49.86 million over the five-year period from FY2021 to FY2025, with a compound annual growth rate (CAGR) of 37.4%. Notably, their cash conversion rate stands at an impressive 112.6%, consistently surpassing their 100% target. This indicates a high proportion of their earnings being directly converted into cash, which can be reinvested or distributed to shareholders.

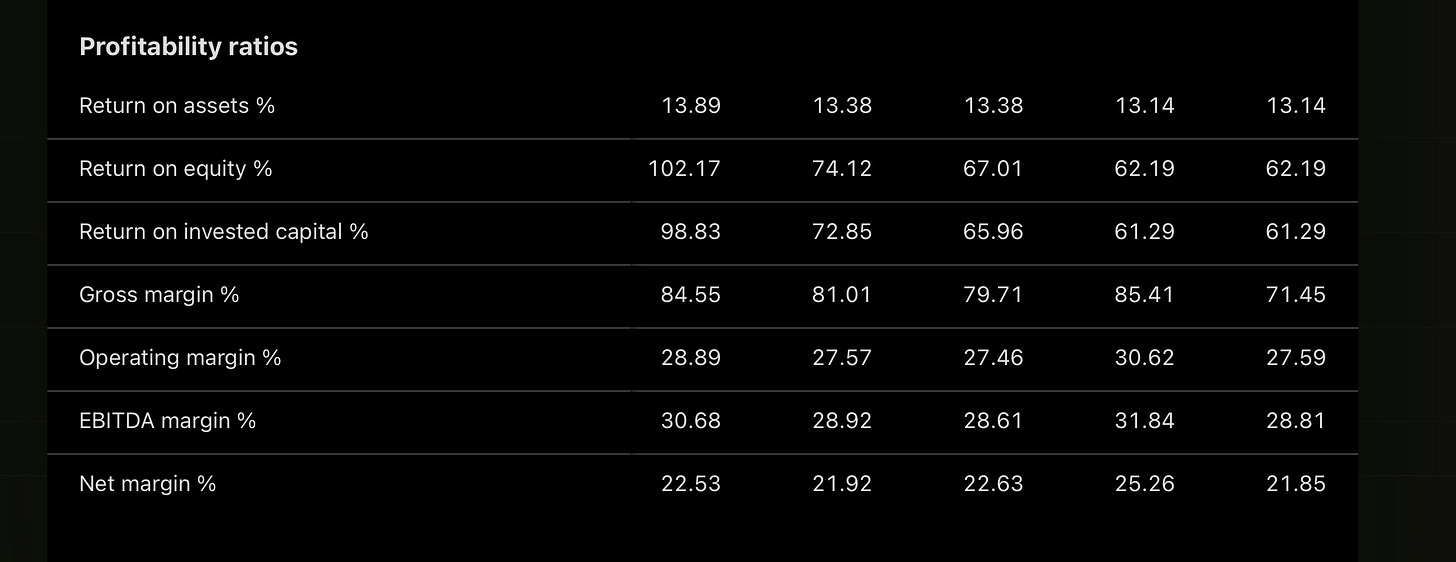

Superior Return on Capital (>20%) (Score: 5/5): Bytes is a real winner when it comes to profitability! Their return on capital (ROIC) is consistently > 60%, which is a score of 5/5. Check out the Trading View table below for some impressive ROE and ROIC figures. They’ve been raking in profits for the past five years, with ROE ranging from 62% to 102%! And their strong net cash position just adds to their impressive track record. They are clearly a formidable and long-term competitor.

Strengthening Profit Margins (Score: 4/5): Despite accounting nuances that make revenue comparisons tricky, Bytes has shown a clear trend of expanding operating and net margins. Operating margin has been consistently above 27% since FY2021 demonstrating strong operational leverage.

Genuine Organic Growth (≥5–9%) (Score: 4/5): While recent headwinds have temporarily impacted reported revenue, Gross Profit (a more accurate measure for a VAR) has grown at a robust 16.1% CAGR from FY2021 to FY2025. This is well above the 5-9% criterion, driven by high customer renewal rates (109% in 2024/25) and new customer acquisition. Their modest 4% market share in a growing market offers substantial runway.

This culminates in an Elite Compounder Score of 23/25, a rare feat that underscores the fundamental quality of this business.

Leadership Under Scrutiny:

A Test of Character

The abrupt resignation of former CEO Neil Murphy in February 2024, attributed to undisclosed share trades, raised concerns about corporate governance. However, the board’s prompt and transparent response—an internal investigation that revealed no broader misconduct, Murphy’s sincere apology, and the forfeiture of his performance-related benefits—signalled a commitment to accountability. The appointment of Sam Mudd, a seasoned and respected company leader, as the new CEO further underscores stability and continuity. Despite the unsettling nature of the events, they were handled with integrity, reinforcing trust rather than damaging it in the long term.

Bytes' capital allocation policy is disciplined:

Excess cash, after organic investment and strategic mergers and acquisitions (M&A), is returned to shareholders. They consistently pay dividends, with a current yield of 5.57%, and have a track record of increasing payments. Their recent acquisition of a 25.1% stake in Cloud Bridge Technologies Limited in June 2023, aimed at strengthening their multi-cloud strategy, exemplifies their approach to carefully selected acquisitions that enhance value.

The Opportunity and the Path Ahead

Bytes Technology Group's share price, currently around 363.40 GBp, sits significantly below its 52-week high of 563.00 GBp.

The recent plummeting, while painful for existing shareholders, presents a compelling entry point for those with a long-term horizon.

A Five-Year Outlook on Value Creation

I forecast the next five years for Bytes Technology Group using Gross Profit as the lead growth indicator — the most meaningful metric for a Value Added Reseller like Bytes.

My goal: to understand the trajectory of cash generation and what that means for shareholders.

Starting with FY2025’s Gross Profit of £163.3 million (up 12% YoY), I built three scenarios:

Realistic: 12% annual growth (current pace)

Optimistic: 14% (a modest acceleration)

Pessimistic: 10% (slight deceleration)

I assumed operating profit, net income, and free cash flow (FCF) scale proportionally — a fair assumption given Bytes’ lean operations and impressive cash conversion. I also held the share count steady at ~241 million and applied the current P/FCF multiple of 11.6x to estimate future share prices.

Here’s what that looks like by FY2030:

Realistic case: FCF grows to £133 million, implying a share price of 641p

Optimistic case: FCF hits £145 million, pointing to 700p+

Pessimistic case: FCF still grows to £122 million, supporting 586p

Even in the most cautious scenario, I see meaningful compounding. The business is capital-light, operationally disciplined, and consistently cash generative — a powerful combination for long-term investors. These projections aren’t crystal balls, but they offer a clear signal: if Bytes continues executing, shareholders stand to benefit.

Of course, risks remain.

A prolonged macroeconomic downturn could further defer IT spending. The sales team restructuring needs to yield its intended benefits. The competitive landscape is intense, and the ongoing digital skills shortage could impact capacity . Geopolitical tensions, while not directly impacting Bytes' software-heavy business, could indirectly affect customer confidence.

However, the confluence of powerful industry tailwinds, a robust business model, strong competitive moats, a fortress balance sheet, and a management team that has demonstrated resilience and integrity, positions Bytes Technology Group as a compelling "Buy" for the discerning investor. This is a company that, in my view, possesses the fundamental characteristics to compound capital for years to come, offering a rare blend of quality and opportunity in today's market. The recent dip, far from being a red flag, might just be the market's gift to those willing to look beyond the immediate noise.