The World's Most Undervalued Tech Giants: A $3 Trillion Secret Hidden in Plain Sight

How a forbidden investment could be like buying Amazon and Apple at 2000 prices—but with 2025 technology

From Trade War to Tech Renaissance: The Great Reversal

When the first salvos of a global trade war were fired with tariffs on steel and soybeans, few predicted it would morph into a broader rivalry spanning semiconductors, telecom giants, and AI supremacy. Years later, caught in this crossfire are the tech stocks of the world's second-largest economy — whipsawed by geopolitical tension and domestic crackdowns, one moment darlings of global growth, the next battered by new regulations or export bans.

Yet today, something remarkable is happening. While American investors obsess over whether the "Magnificent Seven" can justify P/E ratios of 45.5x and revenue multiples approaching double digits, an extraordinary arbitrage opportunity sits hidden in plain sight. A collection of 100 companies from this emerging tech superpower — worth $3 trillion combined — trades at just 2x revenue. To put this in perspective, that's like buying an entire national tech ecosystem for the price of a single mediocre SaaS company in Silicon Valley.

This volatile backdrop sets the stage for an intriguing proposition: what if the market's greatest blind spot is also its greatest opportunity?

The Innovation Index: More Than Meets the Eye

MSCI China Technology All Shares Stock Connect Select Index (Index Code: 737890)

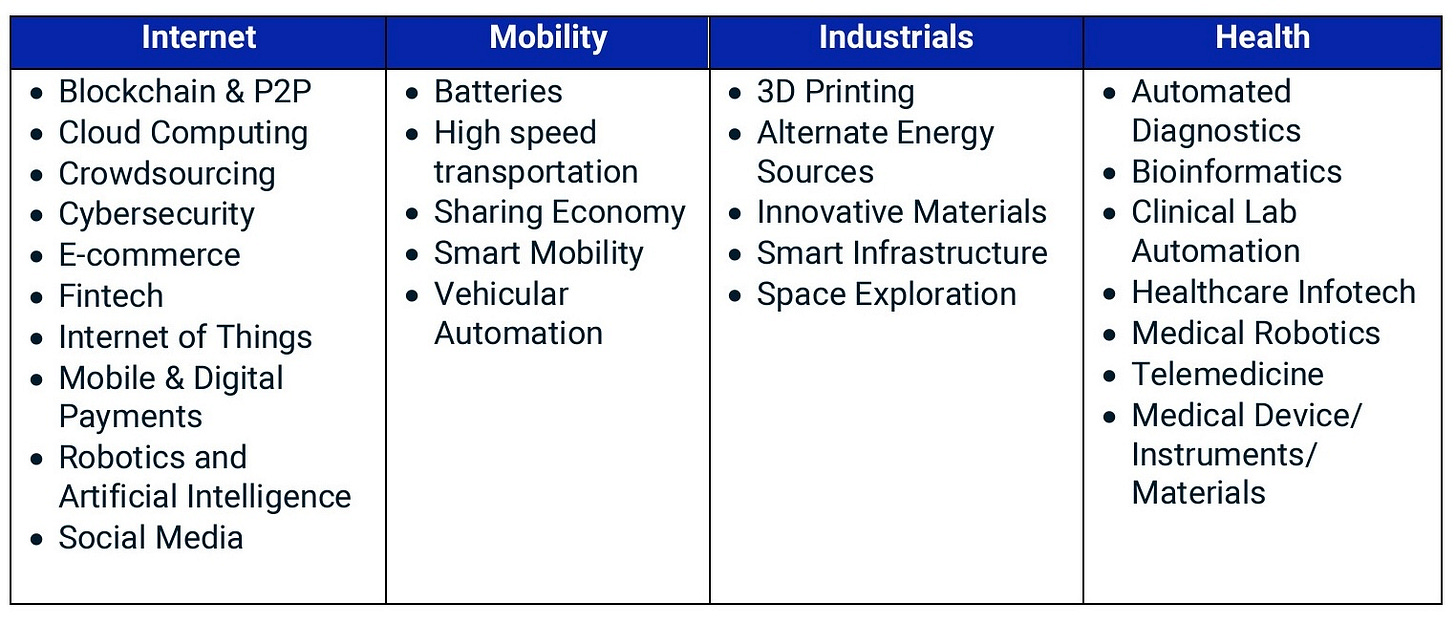

Launched in mid-2018 around the time trade tensions began heating up, a sophisticated technology index was created to track the emerging tech champions of this economic powerhouse. But this isn't your typical market-cap weighted index. The index applies a sophisticated "Relevance Score" for each company, measuring how much of its revenue comes from cutting-edge tech themes like digitization, mobility, automation, artificial intelligence, and digital healthcare.

Only companies with at least a quarter of their business in these innovation areas make the cut. In other words, a boring state-owned telecom might be huge, but if it's not innovating, it's out — whereas a smaller online platform or EV startup could qualify if it's truly tech-focused.

Once identified, these tech-oriented players are weighted in a novel way. Instead of straight market cap ranking, each stock's weight is tilted by its tech "relevance." The index multiplies each company's free-float market value by that Relevance Score. A firm deeply involved in AI and autonomous driving gets an extra boost relative to its size. This approach emphasises companies at the forefront of this nation's innovation push while maintaining a 10% cap on any single stock.

Disclaimer: I hold and continue to add positions in the index via Invesco on Invest Engine (currently available only for UK residents) - A great index fund only investment platform for UK Retail Investors offering access to nearly 800 ETFs. Use my referral code to open an Invest Engine account.

If you’re short on time, or if you’re a commuter like me and prefer listening on the go, you might enjoy the 19-minute audio summary generated by Notebook LM. This audio overview is based directly on my essay and offers a convenient way to catch up on the key points during your journey.

The Numbers That Redefine "Undervalued"

The resulting portfolio reveals staggering scale trading at unthinkable valuations. The index constituents generate $1.5 trillion in annual revenue — more than Amazon and Apple combined. They serve over one billion customers, operate the world's largest e-commerce platforms, power millions of homes with clean energy, and manufacture everything from the world's most advanced smartphones to the batteries that will electrify the planet.

Consider the titans at the top:

The Eastern Amazon (11.85% of index): $138 billion annual revenue with a 13% profit margin and $65 billion in cash. Despite serving 900 million active customers and handling billions of parcels annually, it trades at a fraction of Amazon's revenue multiple.

The Asian Meta (11.19% of index): $94 billion annual revenue with an exceptional 29.4% net margin. Its super-app has over 1.2 billion users—more than the entire population of Europe. Its gaming revenue exceeds Sony, Microsoft, and Nintendo combined, yet it trades at just 29x earnings.

The Eastern Apple (10.62% of index): $51 billion revenue, shipping 168 million smartphones globally in 2024. This manufacturing powerhouse operates with remarkable efficiency: $14.5 billion in cash against just $4.9 billion in debt.

The list continues with equally impressive fundamentals: the nation's Walmart-sized e-commerce platform with $166 billion in revenue, the world's largest EV manufacturer with $111 billion in sales, and a battery company controlling 37% of the global EV battery market.

Yet these giants trade at valuations that would be unthinkable in the West. The entire index trades at 24x net income and 48x free cash flow—multiples that make even value investors' hearts race.

The European Perspective: A Tale of Two Continents

For European investors, the contrast is even more striking. While Germany's DAX 40 typically trades at P/E ratios between 14 and 22, and SAP commands premium multiples despite slower growth, companies from this emerging tech economy delivering faster growth and larger scale trade at fractions of comparable European multiples.

The analogy extends beyond valuation. Just as SAP dominates enterprise software in Europe, companies in this eastern economy are building digital sovereignty software stacks for 1.4 billion people. Just as Siemens powers European industrial automation, firms from this region are automating factories across Asia.

Take Flat Glass Group, described as "China's Saint-Gobain," which dominates solar glass manufacturing globally. Or consider Sungrow Power, "China's Enphase meets Siemens Energy," the world's number one supplier of PV inverters. These aren't followers — they're setting global standards. Yet they trade at half the multiples of their European counterparts.

The American Comparison: David vs. Goliath Valuations

The comparison with American tech reveals even more dramatic disparities. The S&P 500 Information Technology sector trades at a P/E ratio of 35.08, while the "Magnificent Seven" command multiples that would make financial advisors blush.

Consider these remarkable parallels:

The Eastern Meta vs. Western Meta: The eastern giant operates a super-app with 1.2 billion users, owns the world's largest gaming business, runs the region's second-largest cloud platform, and maintains the country's leading social media ecosystem. It generates superior profit margins (29.4% vs. Meta's lower teens) yet trades at a fraction of Meta's valuation.

Eastern Tesla vs. Western Tesla: The eastern EV manufacturer outsold Tesla globally in 2024, operates the world's second-largest battery business, runs integrated supply chains from lithium mining to final assembly, and achieved record 2024 revenue of $107 billion. Yet it trades at valuations that make Tesla look like a speculative venture.

Eastern Battery Giant vs. LG Energy: This company is the world's largest battery manufacturer with 37% global market share, supplies Tesla, BMW, Volkswagen, and virtually every major automaker. It operates with technological advantages that Western competitors struggle to match.

The innovation reality is stark: these aren't copycats—they're the companies setting tomorrow's standards.

The Innovation Reality Check: Beyond the Copycats

Perhaps the most outdated assumption is that Chinese companies are mere imitators. This was true in 2005 — it's fantasy in 2025.

DeepSeek's AI Revolution: The emergence of DeepSeek has fundamentally shifted perceptions. Achieving GPT-4 level performance at a fraction of the cost represents exactly the kind of leapfrog innovation that redefines entire industries. Tencent's integration of DeepSeek into WeChat signals how quickly Chinese platforms can deploy cutting-edge AI at massive scale.

Battery Technology Dominance: CATL doesn't just compete with Western battery makers—it's already won. LONGi Green Energy ("China's Tesla for crystalline solar energy") has achieved world record efficiency in solar cells repeatedly. These companies aren't playing catch-up; Tesla, BMW, and Ford depend on them for their electric futures.

Manufacturing Excellence: Foxconn Industrial Internet operates "lights-out" factories with AI-driven automation that puts Industry 4.0 theory into practice. Will Semiconductor ("China's Sony Imaging + Analog Devices") designs sensors that power everything from smartphones to autonomous vehicles.

Platform Scale: Companies like NetEase ("China's Activision Blizzard meets Spotify") and Kuaishou ("China's YouTube meets TikTok") operate at scales that dwarf Western counterparts, yet trade at fraction of the valuations.

Boom, Bust, and Fragile Renaissance

The journey hasn't been smooth. Since 2018, Chinese tech stocks have been on a rollercoaster worthy of Shenzhen's theme parks. Early years saw surging enthusiasm as China's internet firms posted rapid growth. By February 2021, the index peaked, buoyed by pandemic-era digital adoption.

Then came the great reckoning. Over the next three years, China's tech sector was slammed by a perfect storm: regulatory crackdowns at home and growing hostility abroad. From that early 2021 high to the trough in early 2024, the index lost nearly 70% of its value — a collapse as harrowing as the Nasdaq dot-com bust.

Yet when gloom seemed relentless, recovery flickered. In late 2022 and through 2023, Chinese authorities began toning down hard-line stances, signaling support for digital platforms. The index rebounded about +44% over the most recent year through Q1 2025, with companies like Alibaba up 69% and Tencent up 31% in 2025 alone.

However, context is crucial: this rebound comes after a much larger drawdown. The index's volatility has been extraordinary — roughly 35% annualised, far exceeding global tech's ~24%. But for contrarian investors, this volatility has created the opportunity of a generation.

The Catalysts Aligning: Policy, AI, and Market Rotation

Several powerful forces are converging to support Chinese tech:

Government Policy Shift: President Xi Jinping held meetings with tech leaders including Alibaba co-founder Jack Ma and DeepSeek founder Liang Wenfeng, telling them he would not impose unwarranted fines and encouraging continued innovation. This represents a 180-degree turn from 2021-2022 crackdowns.

AI Integration Acceleration: Goldman Sachs projects AI adoption alone could boost Chinese corporate earnings by 2.5% annually for the next decade, unlocking $200 billion in new investment flows. Chinese companies are proving they can innovate at the cutting edge, not just implement Western technology.

Economic Stimulus: China's central bank has been cutting rates with more expected. Unlike Western stimulus that primarily inflated asset prices, China's measures target real economic activity and infrastructure investment.

Market Rotation: After years of underperformance relative to U.S. tech, institutional investors are recognizing the arbitrage opportunity. As one analysis noted, "2025 has seen a dramatic shift. While US tech stocks have cooled, China's tech leaders are up sharply."

Geopolitics: The Wild Card Factor

No discussion is complete without addressing the elephants in the room: Beijing's regulators and Washington's policymakers. The Chinese Communist Party's attitude toward big tech shifted markedly around 2020, putting brakes on everything from fintech lending to video game approvals.

Meanwhile, the U.S.-China tech rivalry has expanded beyond trade tariffs into a battle over technological dominance. Export controls limit China's access to cutting-edge semiconductors, while Chinese firms face restrictions in American markets.

This tech cold war introduces significant risks but also opportunities. It explains why the China Tech index trades at a valuation discount — its forward P/E of around 17.8x is noticeably lower than the ~24x for MSCI World Tech. Investors are pricing in a "risk premium" for geopolitical uncertainty.

But one investor's risk is another's opportunity. Companies like Hygon Information Technology ("China's AMD") and Loongson Technology ("China's AMD meets RISC-V") are developing sovereign CPU capabilities precisely because of these restrictions. Technological decoupling is driving innovation, not stifling it.

The Access Point: Stock Connect's Gateway

For international investors, the Stock Connect mechanism provides unprecedented access. The Invesco MSCI China Technology ETF (MCHT LN) offers exposure through a UCITS-compliant fund trading in London. Despite a 0.49% expense ratio and volatile track record since launching in 2021, it provides liquid access to this concentrated innovation bet.

The MSCI China Technology All Shares Stock Connect Select Index represents an investment in the technological infrastructure of the world's second-largest economy. In a world of expensive growth stories, it offers the increasingly rare opportunity to buy proven, profitable, growing companies at prices that discount decades of potential disappointment. For patient investors willing to navigate geopolitical crosscurrents, that asymmetry may prove irresistible.

The ETF's journey mirrors the broader sector: launched near market peaks, weathered the storm, and now positioned for potential recovery as sentiment shifts.

European Lessons: Infrastructure as Destiny

European investors understand how infrastructure creates competitive moats. Just as Deutsche Telekom's networks, SAP's enterprise lock-in, and ASML's technology monopolies create sustained advantages, Chinese tech companies have built digital infrastructure equally difficult to replicate.

Alibaba's logistics network represents decades of optimisation. Tencent's social graph encompasses virtually every Chinese internet user. BYD's integrated supply chain creates manufacturing advantages pure-play competitors can't match. S.F. Holding ("China's FedEx") operates Asia's largest comprehensive logistics network.

These aren't advantages that disappear with product cycles. They're structural moats that compound over time, generating sustainable returns that built European industrial champions over decades.

Contrarian Bet or Fool's Errand?

The truth is complex. On one hand, you have a sector with undeniable long-term growth drivers. China's digital economy is massive and growing; its government pours resources into tech innovation. Many Chinese tech companies are profitable, trade at cheaper valuations than peers, and have huge addressable markets.

The recent rebound and supportive signals from Beijing could indicate the worst is over — the classic contrarian play when sentiment recovers from rock-bottom. The index is almost a proxy for betting that China's innovation drive will triumph despite headwinds.

On the other hand, regulatory clampdowns may ebb and flow, but there's no guarantee they're over. Geopolitically, the East-West tech divide seems likely to widen rather than heal. This inherently volatile, concentrated strategy isn't for those seeking stable growth.

The Investment Case: Quality Meets Opportunity

The investment thesis ultimately rests on a simple proposition: quality companies trading at substantial discounts rarely remain cheap forever.

Scale Advantage: These companies operate in the world's largest consumer market, with 1.4 billion people increasingly demanding sophisticated digital services.

Innovation Leadership: From AI and batteries to manufacturing and logistics, Chinese tech companies increasingly set global standards rather than follow them.

Financial Strength: Combined, index constituents generate $228 billion in operating cash flow annually, with $560 billion in cash on balance sheets.

Valuation Discount: At 2x revenue and 24x earnings, these companies trade at massive discounts to both historical norms and international comparables.

Structural Moats: Like European industrial champions, these companies have built digital infrastructure that creates sustained competitive advantages.

The Bottom Line: The Arbitrage of a Generation

For investors seeking growth at reasonable prices, the MSCI China Tech index presents a compelling proposition. You're buying world-class companies with leading market positions, proven business models generating massive cash flows, innovation leadership in critical technologies, and structural growth drivers from continued digitisation — all at valuations that assume permanent underperformance.

As Morningstar analysts conclude, these wide-moat Chinese companies are among the most undervalued according to current data. The opportunity exists because markets are inefficient over short horizons, particularly when geopolitical noise obscures fundamental value.

But inefficiencies don't last forever. As Chinese companies continue delivering results, as regulatory concerns fade, and as investors recognize the arbitrage opportunity, valuations will likely converge toward fair value.

The question isn't whether these valuations make sense — they don't. The question is whether you're positioned to benefit when the market eventually corrects its most glaring pricing error. In a world where the US-China tariff war has morphed from trade disputes to technology rivalry, betting on China's innovation engine might just be the contrarian play of the decade.

Become a paid subscriber to read my 262-page report on this index.