Robinhood vs Deutsche Bank: When Fintech Eats the Bankers’ Lunch

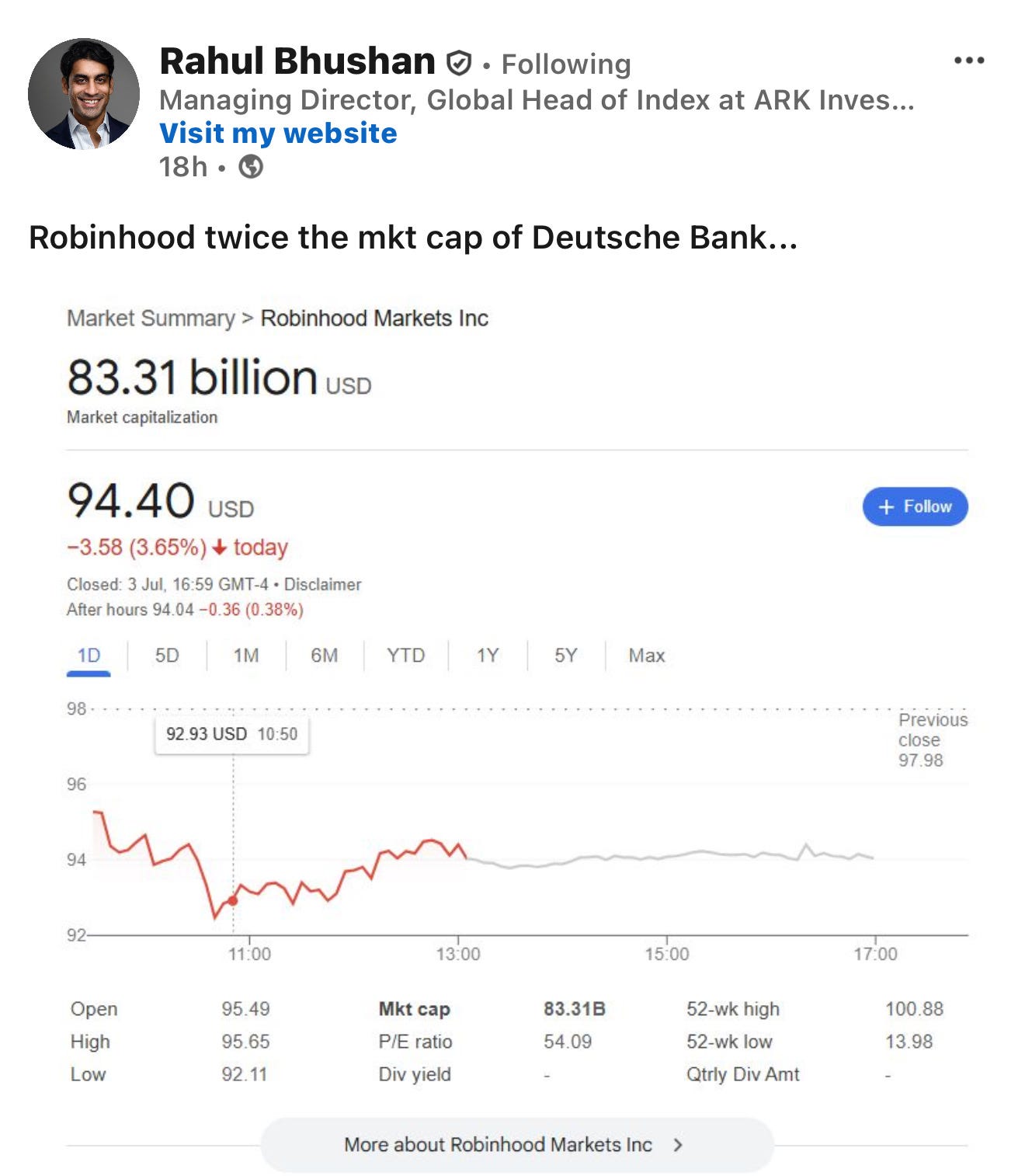

Let me set the scene: it’s a typical Friday afternoon after work, and I’m scrolling through LinkedIn, glass of Sauvignon Blanc from Marlborough, New Zealand in hand, when I stumble across a chart posted by Rahul Bhushan, Managing Director of Index Research at ARK Invest that makes me do a double take.

There it is, in all its digital glory - Robinhood, the upstart trading app, boasting a market cap of $83 billion, nearly twice that of Deutsche Bank, the venerable stalwart of European finance, clocking in at around $59 billion. If you’re wondering whether you’ve accidentally wandered into an episode of Game of Thrones, you’re not alone.

Déjà Vu: The Amazon Analogy

This isn’t the first time Wall Street (or indeed, the City) has handed the keys to the kingdom to a disruptor. Cast your mind back to the late 1990s, when Amazon - then just a scrappy online bookshop - was already being valued higher than many of its brick-and-mortar rivals. Retail titans scoffed, “Who would buy books on the internet?” Fast forward a couple of decades, and Amazon’s market cap dwarfs not only traditional retailers but also the GDP of several countries.

The lesson? Markets have a habit of betting on the future, not the past. And sometimes, just sometimes, they’re right.

Robinhood: The Case for the Crown

So, why is Robinhood, a company younger than most of my houseplants, worth more than Deutsche Bank and nipping at the heels of other banking giants? Here’s the bullish case:

Democratisation of Finance: Robinhood has made investing accessible to the masses - no minimum balances, no intimidating jargon, and, crucially, no commissions. It’s the Amazon Prime of stock trading: frictionless, affordable, and addictive.

Business Model Innovation: Instead of charging users, Robinhood makes its money behind the scenes primarily through payment for order flow, stock lending, and interest on idle cash. This “freemium” model has forced even the old guard to drop their fees.

Growth Metrics: With over 22 million funded accounts and a revenue engine that’s humming along nicely, Robinhood’s growth trajectory is the stuff of fintech legend.

Brand Power: Ask a Gen Z investor where they bought their first share, and odds are it wasn’t at a high-street branch.

Robinhood resonates with Gen Z’s digital-first, meme-powered, younger, plugged-in entrepreneurial world.

If Robinhood is the TikTok of investing, then Deutsche Bank is the BBC - reliable, respected, but not exactly where the viral action happens.

Think of Robinhood as the TikTok of finance: fast, addictive, and built for the swipe-right-now generation. Just as TikTok has left traditional TV scrambling to stay relevant, Robinhood’s app-based trading has left legacy banks looking a bit… analogue. The old guard is still broadcasting, but Gen Z is already remixing.

Robinhood is the viral dance challenge of the financial world.

Robinhood’s rise is as much about meme culture as it is about market mechanics. Remember how GameStop and AMC went viral, fuelled by Reddit and TikTok? Robinhood is the platform where those viral investing moments happen - think “stonks only go up” energy. It’s not just trading; it’s a social movement, a digital flash mob in the stock market.

Robinhood is the charismatic YouTube vlogger dishing out life hacks, while traditional bankers are the stern professors delivering hour-long lectures.

Gen Z trusts “finfluencers” on TikTok and YouTube more than suit-and-tie bankers. Robinhood is the tool of choice for these creators and their followers - trading tips, side hustles, and “how I turned £1,000 into £1,000,000” stories. The old-school banker is yesterday’s news; the finfluencer is today’s financial guru.

Robinhood is the buzzing Discord server where everyone’s swapping tips and memes, whereas traditional bank branches are like outdated community centres with noticeboards and stale coffee.

For Gen Z, community happens in Discord servers, not in marble-floored bank branches. Robinhood is part of this shift: it’s not just an app, it’s a hub for digital-native investors who share, meme, and learn together in real time.

Robinhood is part of a sleek, modern smartphone loaded with apps like Stripe for payments and Venmo for splitting bills, while traditional banks are the clunky flip phone from the early 2000s.

Robinhood’s disruption is part of a bigger trend - think Stripe making payments frictionless, Venmo turning money transfers into social moments, and Coinbase letting you buy Bitcoin in seconds. Gen Z expects finance to be instant, mobile, and shareable.

Robinhood is the DIY startup kit for aspiring entrepreneurs, much like a drag-and-drop website builder empowers anyone to launch a business online.

Gen Z doesn’t dream of climbing the corporate ladder, they want to build something of their own. Robinhood enables this entrepreneurial spirit, letting anyone become an investor, side-hustler, or even a meme-stock legend from their phone.

The Traditionalists: Deutsche Bank and Friends

Let’s not write off the old guard just yet. Deutsche Bank, Barclays, HSBC - these institutions have survived world wars, financial crises, and more than a few rogue traders. Their market caps may look modest compared to Robinhood’s, but they manage trillions in assets and have regulatory moats wider than the Thames.

JP Morgan - $820B

Wells Fargo - $270B

Goldman Sachs - $222b

Charles Schwab - $160B

Robinhood - $83B

Barclays - $63B

Deutsche Bank - $57B

Yes, you read that right - Robinhood is worth more than Barclays and Deutsche Bank, and is not far off some regional US banks.

Is Robinhood Overvalued?

Of course, not everyone is buying what Robinhood’s selling (at least not at this price). The sceptics have a few points:

Profitability Concerns: Robinhood’s revenue model relies heavily on volatile sources like crypto trading and payment for order flow, both of which are under regulatory scrutiny.

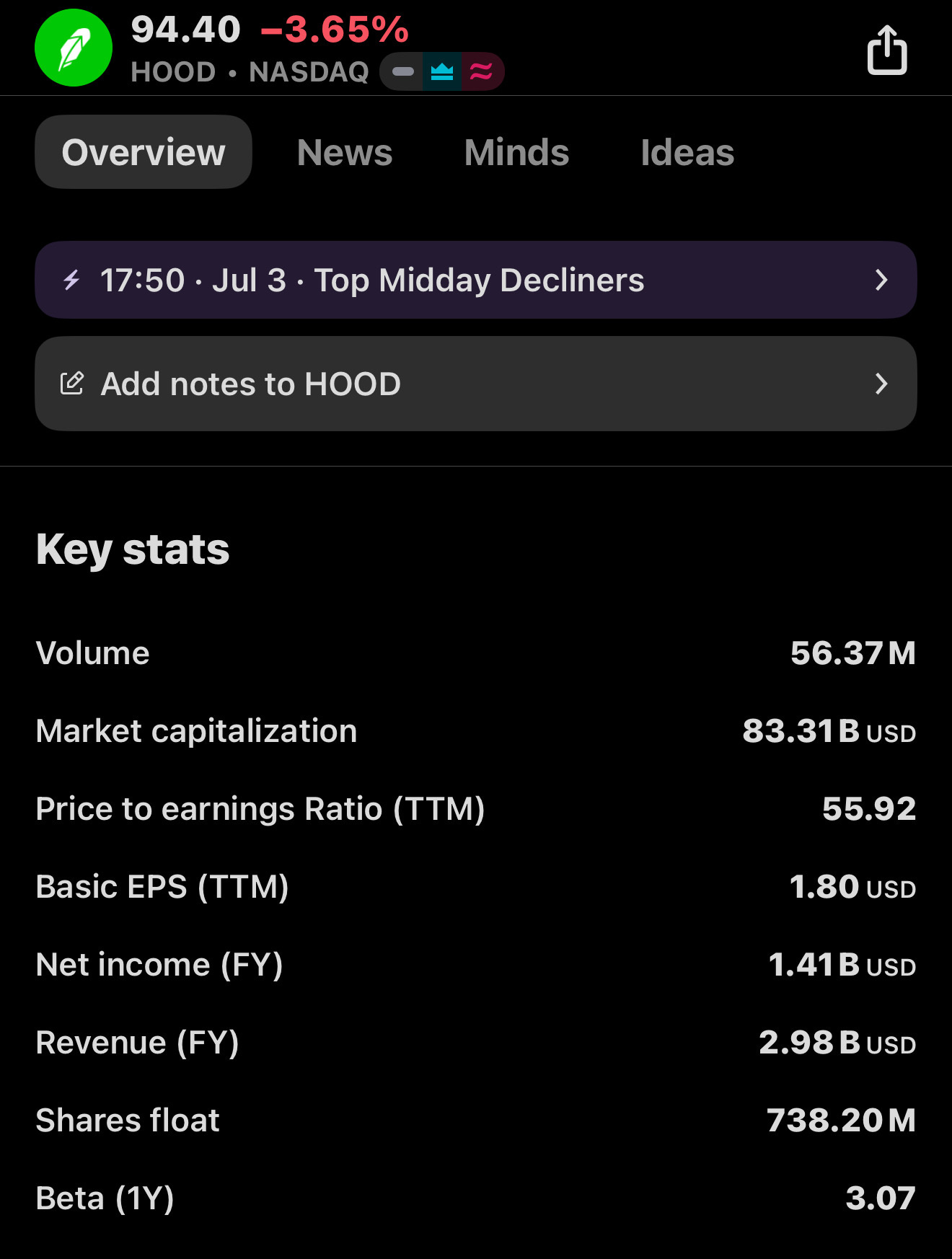

Valuation Metrics: With a P/E ratio north of 50 and an EV/EBITDA multiple that would make a tech unicorn blush, Robinhood’s valuation looks frothy compared to its banking peers.

Sustainability: Can Robinhood keep up its growth, or will it fizzle out like so many fintech darlings before it? The jury’s still out, especially as interest rates and trading volumes fluctuate.

Risk Profile: Let’s not forget, banks like Deutsche Bank are systemically important and subject to rigorous oversight. Robinhood? Not so much (yet).

The Punchline: Betting on the Future

So, is Robinhood’s valuation madness or method? If history is any guide, markets are willing to pay a premium for growth, innovation, and the promise of a new way forward. Amazon was once the plucky upstart; now it’s the establishment. Robinhood may just be following the same script.

But as with all good stories, there’s a twist: the disruptors of today can become the dinosaurs of tomorrow. For now, though, Robinhood’s market cap is the ultimate fintech flex - a reminder that in finance, as in life, the future belongs to those who dare to rewrite the rules.

Now, if you’ll excuse me, I’m off to check if my houseplants are worth more than a regional bank. Stranger things have happened.

Let me know your thoughts in the comments - are we witnessing the birth of the next Amazon, or just another dot-com déjà vu?

Disclaimer: For Educational Purposes Only

Before you dive into this tale of fintech triumphs and market cap marvels, a quick heads-up from yours truly. This piece is purely for educational and informational purposes. I’m not your financial guru, and this isn’t investment advice. Think of it as a chat over a glass of Marlborough Sauvignon Blanc - entertaining, thought-provoking, but not a roadmap to your next stock pick.