The Content Trap: Why the Netflix-Warner Bros. Integration Demands an Investor Exodus

A Surgical Assessment of Integration Risks, Balance Sheet Erosion, and Regulatory Headwinds in the Streaming Century’s Most Perilous Merger

The Illusion of Synergy and the Reality of Distraction

Netflix’s proposed acquisition of Warner Bros. Discovery (WBD) marks a significant moment in media consolidation, but it poses substantial capital risk for investors. Despite the apparent ‘winner-takes-all’ logic of combining the world’s largest SVOD distribution infrastructure with a century-old studio’s intellectual property library, the transaction’s underlying mechanics reveal potential toxicity.

My hypothesis is that the integration of these two distinct entities will not result in the seamless behemoth the market anticipates, but rather a protracted period of operational paralysis, balance sheet degradation, and regulatory purgatory that will suppress shareholder value for the remainder of the decade.

My investment thesis is binary and brutally direct: avoid the equity.

The reason is surgical. This isn’t a merger of equals or a simple acquisition; it’s a clash of opposing corporate cultures. Netflix, a tech firm known for efficiency, honesty, and debt-funded growth, is trying to swallow a struggling Hollywood studio that’s been through a decade of restructuring, cultural decay, and financial mismanagement. The market’s initial excitement overlooks the challenges of integrating in the post-2025 regulatory and economic environment.

Netflix’s acquisition of WBD has immediate and severe financial consequences. It risks losing its investment-grade credit rating, reduces its free cash flow margins due to WBD’s declining linear assets, and exposes its stock to the volatility of theatrical box office performance, a sector Netflix has avoided. Moreover, the regulatory environment in 2026 is hostile, with the US DOJ, FTC, and UK CMA developing frameworks to prevent such vertical and horizontal consolidation.

I am sitting out of NFLX 0.00%↑ until the integration roadmap is proven — a process that empirical evidence from the AOL-Time Warner and AT&T-Time Warner debacles suggests will take no less than 36 to 48 months. The opportunity cost of holding capital in a company distracted by the Herculean task of unifying incompatible technology stacks, pacifying hostile labour unions, and servicing a ballooning debt load is simply too high. My essay details the forensic evidence supporting a sell/hold recommendation, dissecting the integration challenges, the regulatory headwinds, and the inevitable erosion of shareholder value in the interim.

The Strategic Trap: A Merger of Necessity, Not Strength

To understand the peril of this acquisition, allow me to first deconstruct the strategic desperation that drives it. Consolidation in the media sector is often sold to shareholders as a path to cost synergies and scale. However, the Netflix-WBD transaction is fundamentally defensive. It is a reaction to a saturating SVOD market where customer acquisition costs (CAC) are rising, and churn is accelerating. The strategic rationale relies on the presumption that bigger is safer, yet in the current media ecosystem, size often correlates with slowness and vulnerability to disruption.

The “Winner-Takes-All” Fallacy

The prevailing narrative suggests that combining Netflix’s 260 million+ subscribers with Warner Bros.’ IP (Harry Potter, DC, HBO) creates an unassailable moat. This view is myopic. It ignores the law of diminishing marginal returns in content aggregation. Adding the HBO library to Netflix does not linearly increase pricing power; it merely defends against churn. The cost to acquire this defence, however, is the assumption of a legacy infrastructure that is fundamentally at odds with Netflix’s lean operating model.

Netflix has spent fifteen years building a “walled garden” ecosystem where it controls every aspect of the value chain, from production to delivery. Acquiring WBD introduces variables Netflix cannot control: global theatrical distribution windows, declining cable network affiliate fees, and complex sports rights obligations. This dilutes the purity of the Netflix business model, transforming it from a high-growth tech platform into a sluggish media conglomerate burdened by the very legacy assets — linear TV channels like TNT and CNN — that the market is currently discounting to zero. The acquisition forces Netflix to manage the managed decline of linear assets, a task that has stumped the finest minds at Disney and Paramount.

The Distraction of Integration

History serves as a grim guide. The merger of AOL and Time Warner destroyed billions in value not because the assets were worthless, but because the integration was impossible. Similarly, AT&T’s acquisition of Time Warner failed because a telecommunications utility could not foster a creative culture, leading to a mass exodus of talent. Netflix faces a similar precipice. The management bandwidth required to integrate WBD’s sprawling operations — ranging from theme parks and consumer products to cable news and sports broadcasting — will divert attention from Netflix’s core competency: product innovation and algorithmic recommendation.

In the technology sector, stagnation is death. While Netflix management is occupied with the forensic accounting of WBD’s debt and the diplomatic relations required to soothe Hollywood guilds, competitors like Amazon and Apple — who treat media as a loss-leader for broader ecosystems — will continue to innovate without the friction of integration.

The strategic trap is thus set:

Netflix buys WBD to secure its dominance, but in doing so, it creates the very operational drag that erodes its competitive advantage. The focus shifts from “how do we delight the user?” to “how do we integrate the payroll systems?”—a shift that historically marks the top of a tech company’s growth curve.

The Gaming and Ad-Tech Misalignment

Netflix has nascent ambitions in gaming and advertising. WBD has a substantial gaming division (Warner Bros. Games) and a legacy advertising sales arm. While this looks like synergy on paper, the integration is fraught. Warner Bros. Games is built on a traditional “hit-driven” console release model (e.g., Hogwarts Legacy), whereas Netflix is pursuing a mobile-first, subscription-based gaming strategy. Integrating these two distinct business models is not a simple bolt-on; it requires a fundamental restructuring of how games are greenlit, monetised, and distributed. Similarly, merging WBD’s traditional upfront-based ad sales team with Netflix’s programmatic, tech-led ad platform will create friction between “Mad Men” relationship selling and “Math Men” algorithmic selling.

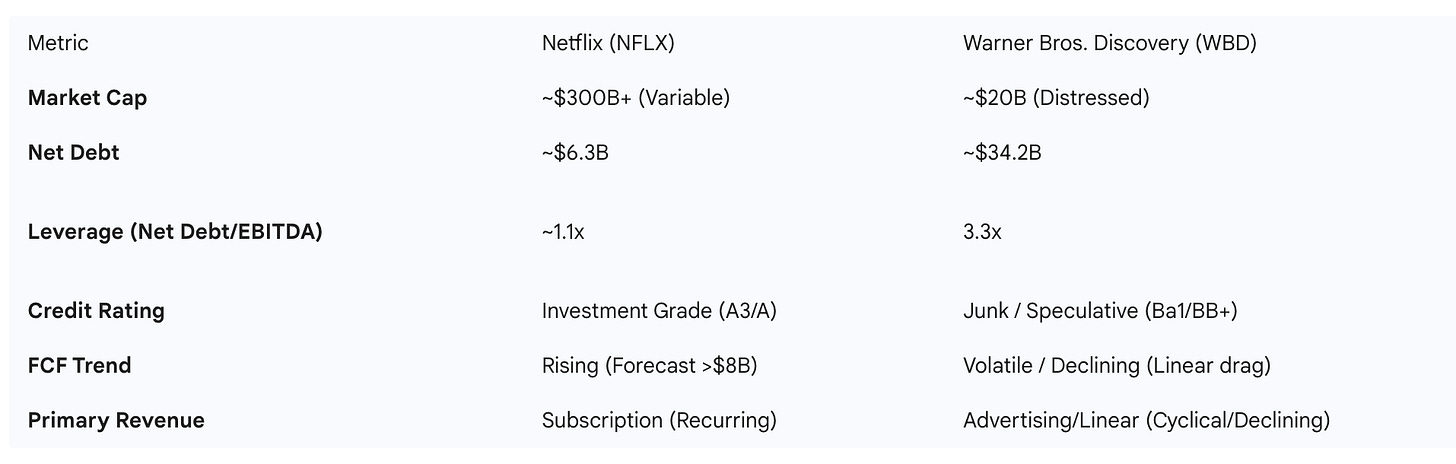

Financial Surgery: The Balance Sheet Nightmare

The most immediate and quantifiable risk to the Netflix investor is the deterioration of the balance sheet. For years, Netflix navigated a delicate path of debt-funded content spending, eventually reaching a point of self-sustaining free cash flow and achieving investment-grade credit ratings. This acquisition threatens to undo that progress overnight, re-leveraging the company at precisely the moment when capital costs are historically elevated and credit spreads are widening for lower-rated issuers.

The Debt Burden: Quantifying the Load

Netflix currently carries approximately $16B in long-term debt. While manageable for a company of its scale, this debt profile is structured around the predictability of subscription revenue. Warner Bros. Discovery, conversely, is a debt-laden entity. As of December 2024, WBD reported long-term debt of approximately $40B.

In a merger scenario, the combined entity would shoulder a gross debt load exceeding $56B, not including the new debt required to finance the cash portion of the transaction. This places the combined entity in a precarious leverage position. WBD’s net leverage ratio stood at 3.3x as of Q3 2025 , a figure already considered high for the current interest rate environment. Netflix, which recently achieved an upgrade to A3 from Moody’s and A from S&P based on a leverage target of <2.0x, would see its leverage metrics deteriorate significantly.

The implications of this leverage spike are two-fold. First, the cost of capital increases. WBD’s debt is currently rated below investment grade (junk status), with Moody’s rating its senior unsecured notes at Ba3 and S&P rating it at BB+. Netflix’s acquisition would likely trigger a review of its own credit rating. If the combined entity’s leverage remains above 2.5x for a sustained period — a scenario S&P has explicitly flagged as a downgrade trigger — Netflix could lose its "A" status. This would increase the cost of servicing existing floating-rate debt and make future borrowing for content production significantly more expensive.

The Off-Balance Sheet Iceberg

The visible debt is only part of the liability equation. The “content obligations”—commitments to pay for programming that has been licensed or ordered but not yet delivered — represent a massive off-balance sheet liability.

Netflix’s 2024 10-K reveals approximately $6.2 billion in content liabilities on the balance sheet, but explicitly notes that off-balance sheet commitments are “significant”. Historically, these have ranged between $15 billion and $20 billion. WBD, with its heavy reliance on long-term sports rights (NBA, NHL, MLB) and multi-year talent deals, carries an even murkier liability profile.

The recent settlement with the NBA, extending partnership rights for 11 years , while strategic, imposes fixed-cost obligations that must be paid regardless of the economic climate. In a recessionary environment where advertising revenue (a key component of WBD’s linear model) contracts, these fixed costs become a millstone around the neck of free cash flow. Netflix has historically avoided such long-term sports liabilities specifically to maintain operating flexibility. Inheriting them reduces the company’s ability to pivot its content spend in response to subscriber metrics — a core tenet of the Netflix strategy described in its own annual reports.

Free Cash Flow Dilution

Netflix’s bullish thesis has long relied on the explosion of Free Cash Flow (FCF) as content spend stabilises. Moody’s projected Netflix would generate over $8 billion in FCF per annum. WBD, by contrast, struggles with FCF consistency due to the volatility of theatrical releases and the secular decline of linear TV.

In Q3 2025, WBD generated $701 million in FCF, but this was heavily impacted by separation-related items and interest payments. Integrating WBD introduces a “drag” on Netflix’s FCF margin. The costs of restructuring — severance, lease terminations, and contract buyouts — will consume billions in cash over the first 24 months. We have seen this movie before: the “synergy” targets of $5B touted in the Discovery-WarnerMedia merger were largely achieved through brutal cuts that damaged the product and alienated talent, rather than through genuine operational efficiency.

Investors must ask:

“Why dilute the high-quality, recurring FCF of Netflix with the lower-quality, volatile cash flows of WBD? The blended FCF yield may optically look higher, but the quality of that cash flow is significantly lower, subjected to the whims of the advertising market and box office receipts. In addition, the massive $15B share buyback program authorised by Netflix in December 2024 would almost certainly be frozen to preserve capital for the acquisition, removing a key floor under the stock price.”

Cost of Capital and Yield Spreads

The macroeconomic environment in 2025 has seen a widening of credit spreads between single-A rated issuers and BBB/BB rated issuers. Snippets indicate that while investment-grade spreads are tight, the volatility in lower-rated credits is increasing. If Netflix is downgraded to BBB or lower, its cost of debt capital rises.

Yield Spread Risk: Data from late 2025 suggests that the spread between ‘A’ rated and ‘BBB’ rated bonds can widen by 50-100 basis points during periods of stress.

Fallen Angel Risk: If the merger pushes leverage beyond 3.5x, Netflix enters “Fallen Angel” territory (downgrade from IG to High Yield). This would force many institutional bondholders to sell, increasing yield pressure. While fallen angels can offer value to distressed debt investors, for equity holders, this transition usually correlates with significant multiple compression and stock price underperformance.

Operational Quagmire: Integration Risks

If the financials are the skeleton of the disaster, the operational integration is the flesh — and it is already showing signs of necrosis. The challenge of merging two massive technology and content ecosystems cannot be overstated. We must look beyond the PowerPoint synergies to the engineering reality.

The Myth of the Unified Tech Stack

A common synergy in mergers is merging streaming platforms onto a single ‘tech stack’. However, this is a technical nightmare. We saw this during Discovery+ and HBO Max’s migration. It wasn’t a simple switch; it involved months of re-platforming, metadata issues, and user experience problems.

Netflix’s proprietary, highly sophisticated stack built on AWS is optimised for global scalability and algorithmic personalisation. In contrast, WBD’s Max platform sits on a legacy stack cobbled together from HBO Go, HBO Now, and You.i TV technology. Merging these is not just an engineering challenge; it’s an architectural crisis.

Migration Risk: Migrating Max’s 100 million subscribers to Netflix’s backend involves transferring petabytes of user data, watch history, and billing information. The risk of churn during this friction-heavy process is high, and repeating the technical outages during HBO Max’s rollout on a global scale with Netflix’s user base is a high-stakes gamble.

Codebase Incompatibility: Netflix’s engineering culture, based on microservices and rapid deployment, clashes with WBD’s rigid legacy infrastructure. Rewriting WBD’s library metadata to fit Netflix’s recommendation algorithm will be costly, both in engineering hours and capital expenditure.

Outage Vulnerability: Platform instability spikes during migration, as seen in past integrations like Disney+ launch and HBO Max crashes. In the hyper-competitive attention economy, a crash during a premiere event, like a House of the Dragon finale, drives customers to competitors.

Culture Clash: Algorithms vs. Auteurs

Perhaps the most intangible yet destructive risk is the clash of corporate cultures. Netflix’s ‘Freedom and Responsibility’ deck defines its culture of radical transparency, high performance, and minimal regard for tenure. It’s a data-driven meritocracy where content is an asset class optimised for retention.

Warner Bros. is a 100-year-old studio built on relationships, prestige, and the “auteur” theory. It prizes the theatrical experience, the red carpet, and the deference to creative visionaries. These two cultures are immiscible.

The “Data vs. Gut” Conflict: Netflix executives prioritise data-driven decisions and completion rates, while Warner Bros. executives rely on relationships and intuition. This clash of approaches is evident in Christopher Nolan’s departure from Warner Bros. due to the studio’s shift to streaming, and it’s further validated by Netflix’s acquisition of Warner Bros.

Executive Exodus: After the AT&T merger, many creative executives at Warner Bros. left, including Jason Kilar, due to the influence of telecommunications companies. A similar exodus is likely to occur. Creative talent doesn’t want to work for algorithms. If Netflix loses the key relationships that attract talent to Warner Bros., they’re buying an empty shell.

Integration Paralysis: Cultural infighting caused operational paralysis, a key factor in the AOL-Time Warner failure. Decision-making slowed as factions emerged, making it fatal in a fast-moving market like TikTok.

The Talent Revolt

The Directors Guild of America (DGA) and Writers Guild (WGA) have expressed their concerns about the Netflix deal. The DGA, led by theatrical purists, fears that Netflix will bypass theatrical windows, which could harm directors financially and artistically.

Strike Risk: The risk of a strike is not solely triggered by a merger. Unions can slow down work or prioritise other studios for premium projects.

The “Netflix Premium”: To attract talent who prefer theatrical releases, Netflix will have to pay significantly more than the market rate (the ”Netflix Premium”) to compensate for the lack of backend points. This structural cost disadvantage will persist and likely worsen after the merger.

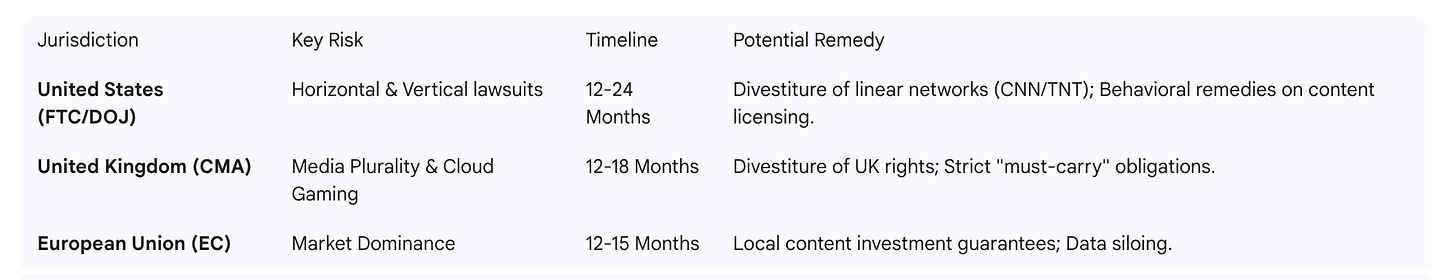

Regulatory Purgatory: The Antitrust Wall

Investors expecting a swift conclusion to this deal are overlooking the geopolitical landscape of 2026. The regulatory environment has shifted against mega-mergers, especially in technology and media. This deal faces a multi-front battle with regulators in Washington, London, and Brussels. Approval is likely to take 18 to 24 months, trapping capital and freezing strategy.

The UK CMA: The New Global Gatekeeper

The UK’s Competition and Markets Authority (CMA) has become the toughest global regulator, as shown by its blocking of the Microsoft-Activision deal. The new Digital Markets, Competition and Consumers Act 2024 (DMCCA), effective January 1, 2025, gives the CMA expanded powers relevant to this transaction.

The “Acquirer-Focused” Threshold: The new DMCCA rules allow the CMA to assert jurisdiction if the acquirer (Netflix) holds at least a 33% share of the UK supply and UK turnover exceeds £350 million. Netflix easily meets this threshold, so the CMA can review the deal even if the target (WBD) has a smaller UK footprint, specifically to prevent ‘killer acquisitions’.

Media Plurality Test: The UK has a specific public interest test for media plurality. The acquisition of WBD includes CNN and possibly UK-based news assets. The Secretary of State can intervene if the merger reduces media plurality, adding a political dimension to the review and allowing the government to block or delay the deal on public interest grounds, separate from pure competition economics.

Vertical Foreclosure Precedent: The CMA’s concern in the Microsoft-Activision case was vertical foreclosure in cloud gaming, fearing Microsoft would make Call of Duty exclusive. In the Netflix-WBD case, they’ll apply the same logic to the ‘Harry Potter’ or ‘Game of Thrones’ IP, fearing Netflix withholding content from rival UK platforms like Sky or Virgin Media. The remedy in the Microsoft case was a complex divestiture of cloud rights to Ubisoft. Netflix might be forced to divest UK licensing rights to a third party, significantly reducing the value of the acquisition.

US Antitrust: The “Input Foreclosure” Theory

In the United States, the FTC and DOJ have adopted the 2023 Merger Guidelines which explicitly target vertical integration.

Horizontal Concentration: Netflix and HBO Max are direct competitors in the SVOD market. If they merged, they would control 30-40% of the market, which would trigger a presumption of illegality under the Clayton Act.

Vertical Input Foreclosure: The DOJ will argue that owning Warner Bros. Studio gives Netflix a crucial ‘input’ (movies/shows) that rivals need. They’ll claim Netflix can foreclose rivals by denying them access to this content, just like they did with the AT&T-Time Warner merger. However, the current regulatory climate is more aggressive.

Labor Monopsony: The FTC has been focusing on labour markets, arguing that a combined Netflix-WBD would have too much power over writers, directors, and actors, which would suppress wages. This aligns with the concerns raised by the WGA and DGA.

The best-case scenario is a deal with significant penalties (e.g., divesting CNN, licensing content to competitors) after 18 months. The worst-case scenario is a blocked deal after 24 months of legal proceedings. In either case, Netflix management is preoccupied for two years.

Valuation & Opportunity Cost: The Investor’s Dilemma

Finally, let’s address the valuation gap. Netflix’s stock has always been overvalued because it’s a ‘pure-play’ tech growth stock. WBD’s stock is undervalued because it’s a conglomerate with declining linear assets. Merging them will inevitably lower Netflix’s multiple.

Multiple Compression

Investors value Netflix’s high growth and low capital intensity, leading to a high P/E ratio. In contrast, WBD’s capital intensity and low growth result in a lower P/E ratio. Combining the two, Netflix’s P/E ratio will likely converge towards the media sector average, effectively diluting its status as a tech platform and transforming it into a diversified media utility.

The Frozen Buyback

In December 2024, Netflix authorised a $15B share buyback programme, which has been crucial for the stock price. A deal of this size ($80B+) would likely require suspending share repurchases to save cash for debt reduction and integration costs. Investors lose the yield support of the buyback immediately upon the deal announcement.

Opportunity Cost

The most damning argument against this deal is the opportunity cost. Netflix can grow without buying a declining cable network. They can expand into live sports, gaming, and advertising without buying WBD. The money spent on WBD could have been used for innovation. While Netflix integrates WBD’s payroll, Amazon and YouTube are building the future of interactive entertainment.

My Conclusion: Sit Out the Drama

The Netflix-Warner Bros. Discovery acquisition is a textbook example of “empire building” at the expense of shareholder value. It offers:

Financial Erosion: A massive spike in leverage ($54B+ debt), a threat to investment-grade ratings, and a dilution of free cash flow quality.

Operational Paralysis: A multi-year integration nightmare involving incompatible tech stacks, warring corporate cultures, and hostile unions.

Regulatory Risk: A high probability of a blocked deal or value-destroying remedies (like the Microsoft-Ubisoft divestiture precedent) after years of litigation in the UK and US.

Strategic Drift: A diversion from the high-growth tech model to a low-growth utility model.

The “brutally surgical” assessment is clear: The potential synergies are dwarfed by the integration costs and risks. The deal solves WBD’s problems by transferring them to Netflix’s balance sheet.

The stock is likely to underperform the broader tech sector as the market digests the magnitude of the debt load and the length of the regulatory battle. Wait for the deal to either collapse (a potential buying opportunity) or for the integration to prove successful (a 3-5 year horizon). Until then, your capital is better deployed elsewhere.

The Debt Trap: A Forensic Look at the Combined Entity

To fully appreciate the financial toxicity of this deal, we must move beyond top-line numbers and examine the granular debt maturity profiles and interest rate sensitivities.

The Maturity Wall

WBD’s substantial debt maturing in the next 3-5 years will be costly to refinance in the current high-interest rate environment, even with recent rate cuts. Netflix’s low weighted average cost of debt is due to its upgrades, while WBD’s is higher. The combined entity’s WACC will be significantly higher than standalone Netflix.

Interest Expense Spike: Pro-forma interest expense could exceed $3-4 billion annually. This is cash that cannot be used for content or buybacks.

Credit Spread Widening: Credit spreads between ‘A’ and ‘BBB’ rated bonds can widen significantly during stress periods. If the combined entity is downgraded to BBB- or BB+, the cost of debt could increase by 100-150 basis points.

The “Junk” Contagion

There’s a real risk of ‘credit contagion’. Rating agencies don’t like levered acquisitions in declining industries.

Moody’s Methodology: Moody’s says large debt-financed acquisitions trigger downgrades.

Covenant Restrictions: WBD’s debt likely has change-of-control covenants that require immediate repayment or renegotiation at current (higher) market rates. This triggers a ‘refinancing wall’ that Netflix must address immediately upon closing.

The Regulatory “Kill Zone”

The regulatory section warrants a deeper dive into the specific mechanisms that will be used to attack this deal.

The UK’s New “Hybrid” Threshold

The CMA’s new powers under the Digital Markets, Competition and Consumers Act (Jan 2025) are a game changer.

The new rules allow the CMA to investigate based solely on the acquirer’s presence, rather than requiring an overlap in the UK. This is designed to catch ‘killer acquisitions’ where a giant buys a target to pre-empt competition.

The CMA will likely demand harsh remedies if Netflix-WBD is seen as a threat to the British broadcasting ecosystem (BBC, ITV). They were the primary blocker of Microsoft-Activision.

US Vertical Enforcement

The DOJ’s 2023 Merger Guidelines lowered the bar for challenging vertical mergers.

The “Foreclosure” Theory: Regulators will model scenarios where Netflix raises the price of Warner Bros. content for rivals (e.g., Sky in the UK, Foxtel in Australia) or withholds it entirely.

Presumption of Harm: The burden of proof has shifted. Netflix will have to prove the deal is pro-competitive, rather than the government proving it is anti-competitive. This lengthens the review process significantly.

Final Verdict: The Integration Tax

In M&A, there is a concept known as the “integration tax” — the hidden cost of lost productivity, low morale, and customer churn that occurs during a merger. For Netflix and WBD, this tax will be levied at the highest marginal rate.

The divergence in business models is too wide. Netflix is a global, direct-to-consumer technology platform. Warner Bros. Discovery is a diversified media conglomerate with heavy exposure to declining linear assets. Attempting to weld these two together creates a Frankenstein’s monster: too slow to compete with Tech, too levered to compete with Content, and too distracted to innovate.

My outlook for the next three years on the stock is:

Short Term (0-12 Months): Stock volatility driven by headline risk, regulatory leaks, and arbitration with unions.

Medium Term (12-36 Months): Earnings drag from integration costs, debt service, and linear TV decline.

Long Term (36+ Months): potential for synergy realisation, but highly speculative.

I am sitting this one out.

All valid points to sit it out, and I think the majority of investors need more clarity. I think overtime Netflix is going to be worth more than it is today, regardless of the acquisition. It’s a bet I’m willing to make today knowing it won’t be a smooth ride.